The steel industry has not really gone through difficulties yet. Illustration

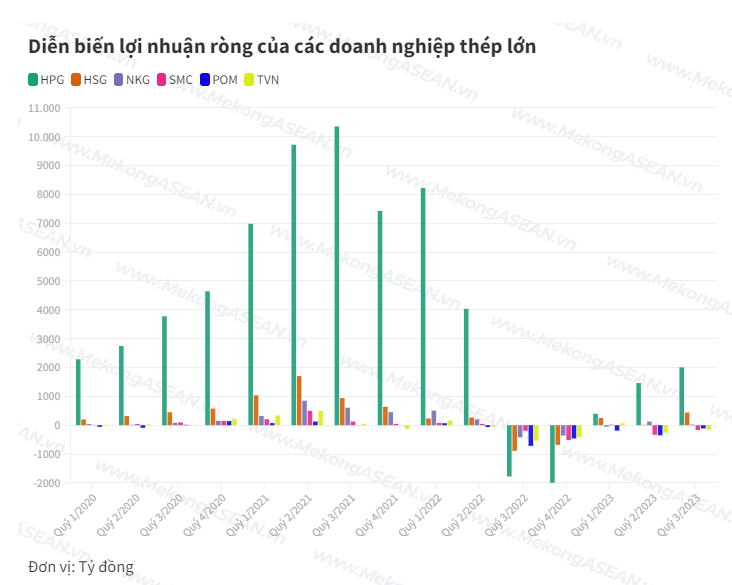

The profit picture of the steel industry in the third quarter had a contrast between large companies and small companies. Among the three leading enterprises in the industry, Hoa Phat Group (HPG code), Hoa Sen Group (HSG), Nam Kim Steel (NKG), HSG recorded the strongest recovery.

Hoa Sen Group recorded revenue in the fourth quarter of the 2022-2023 fiscal year (July 1-September 30, 2023) growing 2% over the same period, reaching VND 8,107 billion. The gross profit/revenue ratio reached 13.2%, helping HSG record a gross profit of VND 1,072 billion, in contrast to the gross profit figure of -231 billion VND in the same period last year.

Thanks to that, HSG's profit after tax in the last quarter reached 438 billion VND, a sharp increase compared to the loss of 887 billion VND in the same period of the previous fiscal year and the highest since the second quarter of 2022.

HPG also recorded an impressive recovery momentum. The group brought in 28,484 billion VND in net revenue, down 16% over the same period last year but gross profit margin increased to 12.6%, from 2.9% in the third quarter of 2022. Thanks to that, the enterprise's profit after tax is 2,000 billion VND, compared to the loss of 1,786 billion VND in the first 9 months of 2022; an increase of 38% compared to the second quarter of 2023.

With Nam Kim Steel, the situation is less positive but the company still has a profit of nearly 24 billion VND in the third quarter of 2023, compared to a loss of 419 billion VND in the same period last year. The enterprise achieved revenue of 4,262 billion VND, down slightly over the same period, gross profit margin reached 4.8%.

Among enterprises with large scale and market share, Vietnam Steel Corporation (VNSteel, TVN) has the most negative results. Ranking second in construction steel market share in the market, the company had the 6th consecutive quarter of revenue decline over the same period, reaching 7,947 billion VND (down 7%).

In addition to the lack of revenue from financial activities and losses of over a hundred billion from joint ventures and affiliates, TVN had a net loss of 155 billion VND, but the good news is that this number has decreased compared to the loss of 535 billion VND of VND. same period 2022.

Looking at other steel enterprises with smaller scale and market share, most still lose money. Pomina Steel (POM code) recorded the deepest revenue decline in the industry with a decrease of 83%, to 503 billion VND; Negative net profit was 111 billion VND, compared to a loss of 716 billion VND in the same period.

The third quarter of 2023 is the 6th consecutive quarter of Pomina Steel's loss. With an additional loss of 647 billion VND in the first 9 months of 2023, as of September 30, 2023, the company recorded an accumulated loss of up to 869 billion VND, equal to 31% of charter capital.

SMC Trading Investment Joint Stock Company (SMC Steel, code SMC) also recorded the second consecutive quarter of negative profits, after the first quarter of 2023 had a profit of 21 billion VND. In the third and fourth quarters of last year, the company also suffered heavy losses.

Specifically, SMC reached 3,141 billion in net revenue in the third quarter of 2023, down 44% compared to the same period last year. Operating below cost plus expenses caused SMC to have a net loss of 164 billion VND, compared to a loss of 188 billion VND in the same period.

Accumulated in the first 9 months of the year, SMC recorded 10,574 billion VND in net revenue, down 44% compared to the first 9 months of 2022; Net loss was 549 billion VND, a sharp increase compared to the loss of 58 billion VND in the same period last year. The continuous loss caused the undistributed profit as of September 30 to be negative 206 billion VND.

Thai Nguyen Iron and Steel (TIS), Vicasa Steel (VCA), Thu Duc Steel (TDS), Nha Be Steel (TNB), Cao Bang Iron and Steel (CBI) also reported losses in the third quarter of 2023. A few small steel enterprises reporting profits include Ho Chi Minh City Metallurgy (HMC), Viet Duc VG PIPE Steel Pipe (VGS) and Tien Len Steel (TLH).

Risk of decline in gross profit margin in the fourth quarter

The second half of last year can be said to be a period of crisis for steel businesses when demand weakened both domestically and internationally, raw material prices, especially coal prices, were three times higher than normal. In addition, difficult credit, sharp increases in exchange rates and interest rates have eroded business profits. Hoa Phat, Hoa Sen and smaller units all lost money.

From the beginning of 2023 until now, the pressure from the above factors has gradually eased, helping steel businesses begin to recover. However, the difficulties have not really passed and the industry's prospects are still not really clear. From March 2023 until now, steel prices have had 19 adjustments, currently fluctuating around 13.7 million VND/ton, the lowest in the past 3 years.

According to the Vietnam Steel Association, the reason domestic steel prices are continuously decreasing is due to slow consumption demand, a small number of civil projects being started, and public investment activities being gradually promoted but not strong enough. help improve the steel market. Meanwhile, domestic manufacturers still have to compete with steel from China when this country continuously lowers export prices.

A positive sign is that in September 2023, the steel industry's consumption output recorded its highest level since the beginning of the year, reaching nearly 2.2 million tons, up 4.7% compared to August and up 9.4%. % compared with the same period last year. Of which, construction steel consumption reached nearly 1 million tons, up 9% and 4% respectively.

In the steel industry outlook report updated at the end of October, Rong Viet Securities (VDSC) said that there is a risk of decline in the gross profit margin of steel enterprises using BOF furnaces (Hoa Phat, Pomina...) This quarter, when coking coal prices are remaining at a high level and steel bar prices cannot increase accordingly (due to low domestic demand).

.jpg)