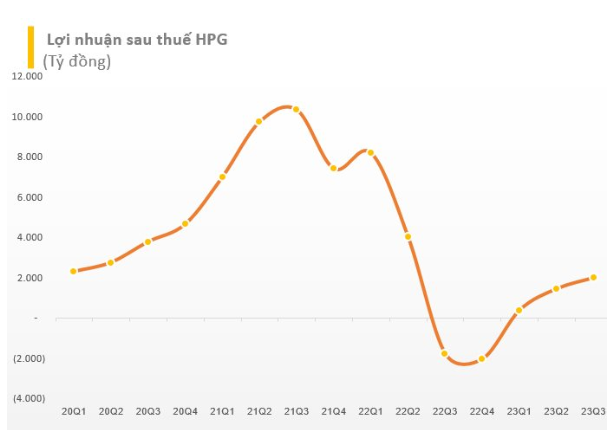

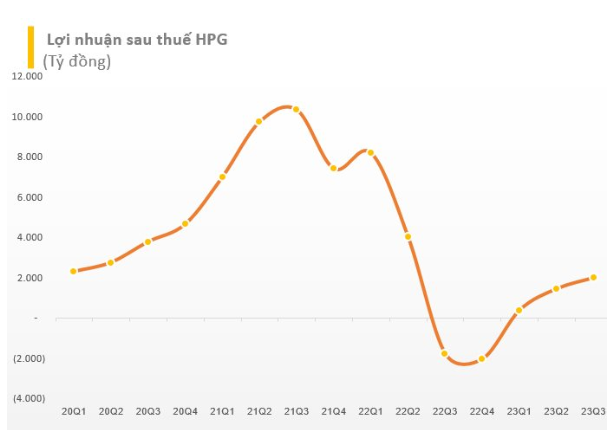

In the newly published report, SSI Research has adjusted the net profit forecast for Hoa Phat (HPG) in 2023 from more than 7,000 billion VND to 5,950 billion VND (down nearly 30% over the same period). The reason for lowering the profit forecast is that the average steel price is adjusted down 2% and the steel price is adjusted up 3% this year.

.jpg)

Thus, according to analysis department estimates, Hoa Phat will record an interest rate of more than VND 2,100 billion in the fourth quarter of 2023, much more likely than the nearly VND 2,000 billion error in the same year.

Previously in the third quarter, large steel enterprises had just received positive information from business results. Specifically, Hoa Phat's net profit reached VND 2,000 billion, an increase of 38% compared to the previous quarter, and showed a significant improvement compared to the error of VND 1,786 billion in the same period last year.

Net gains are provided by improved product consumption, reduced raw material costs and better warehouse inventory management. HPG's static revenue reached VND 28,500 billion in the third quarter of 2023, down more than 16% compared to the high in the same period in 2022.

Besides, construction steel products have improved better than the previous quarter. In the general market context, HPG's consumed products in the third quarter of 2023 reached 921,000 tons, an increase of 17% compared to the previous quarter. Notably, HRC consumption products reached a record high level, HPG sold 766,000 tons of HRC in the third quarter of 2023, an increase of nearly 26% over the same period in 2022 and an increase of 5% compared to the previous quarter, thanks to the export channel. significantly improved with the amount of 433,000 tons.

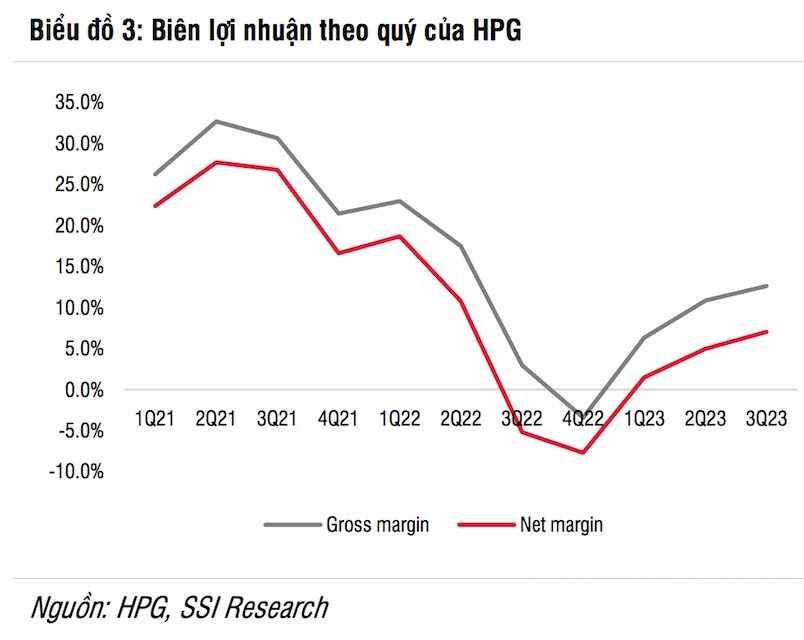

As a result, HPG's profit margin improved at a smooth rate of 13% in the last quarter, from 3% in the third quarter of 2022 thanks to improved consumption products and a decrease in prices of more than 20% compared to the previous quarter. before .

Many optimistic signals in 2024

In 2024, SSI expects construction steel consumption products to recover by 12%, the same period when the real estate market will gradually recover from the second half of the year and disbursement into infrastructure investment remains stable. . Accordingly, operating capacity is expected to improve to 84% in 2024 (from 75.4% in 2023).

In addition, SSI expects the export channel to remain stable next year. According to a recent report of the World Steel Association, steel demand in HPG's key export markets (such as the US, Europe and ASEAN) is expected to increase by 1.6%, 5.8% and 5.8% respectively. 5.2% y/y in 2024, improving from -1.1%, -5.1% and 3.8% in 2023.

For 2024, the analyst team expects powder prices to stabilize at current high levels as supplies improve and demand cools following the peak metallurgical import season in India (which typically falls in the fourth quarter of 2024). 4 and footnote 1).

On the other hand, SSI Research believes that construction steel prices may be due to a decrease in Chinese supplies. "It is unlikely that steel prices will decline further and will recover or stabilize in the short term. However, we do not expect a recovery in strength. China's steel demand is expected to be flat for the year." 2024 and the outcome depends on the Chinese government's support solutions," the report stated.

Based on the assumption that the average price of steel construction and HRC will decrease to less than -1%, resulting in an average decrease of -5% over the same period in iron and metallurgy prices, this securities company expects that HPG's profit margin will improve to 14.7% from 11.4% in 2023.

Thanks to that, SSI Research forecasts that net profit in 2024 will recover significantly by 81% compared to 2023, reaching VND 10,780 billion, although still much lower than the peak in 2021.

.jpg)